Maximize Tax Efficiency with the SMArtX Transition Analysis Tool

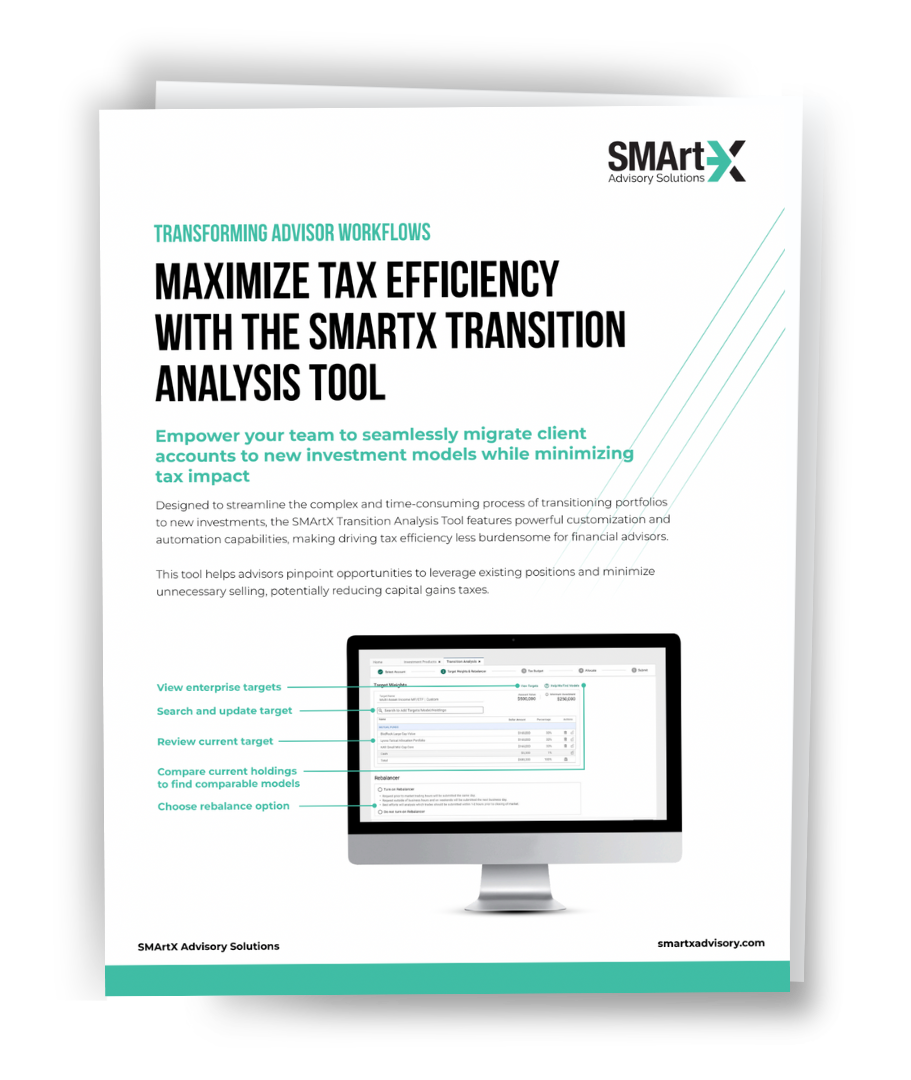

Seamlessly migrate client accounts to new investment models while minimizing tax impact. See how the Transition Analysis Tool empowers advisors with powerful customization and automation capabilities.

Want a closer look?

Schedule a personalized demo of the Transition Analysis Tool.